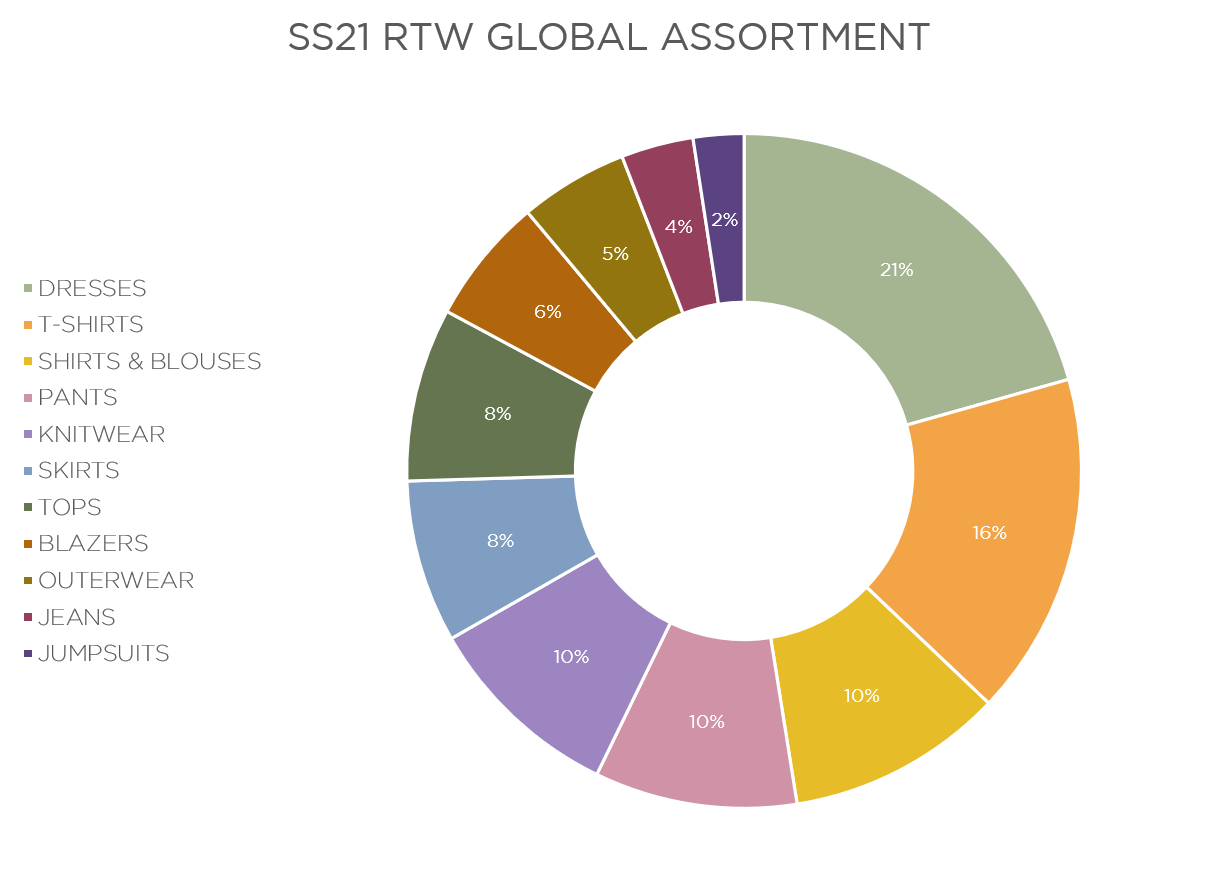

Dresses have the highest percentage of the assortment, representing 21% of RTW. Just below, Tops make up 16%, an increase of 2% from last year. This number is confirming the “over the keyboard dressing” trend. With 10% of the assortment, Shirts & Blouses are respecting the products realistically sold in this period, as long-sleeves.

With same weight within RTW, T-shirts are taking 16% this early SS21, answering to the new casual lifestyle and the need comfort. This year, trousers are more visibly marking their point in the assortment, representing 10% of the offer. Joggers are the most popular sub-category, showing a proportion of 23%. Shorts (22% of pants) are teaming up with blazers for a new, more contemporary tailoring look or as short jeans for a more casual look.

Skirts, on the other hand, have lost ground through this trouser-increase and their suitability to the new normal.

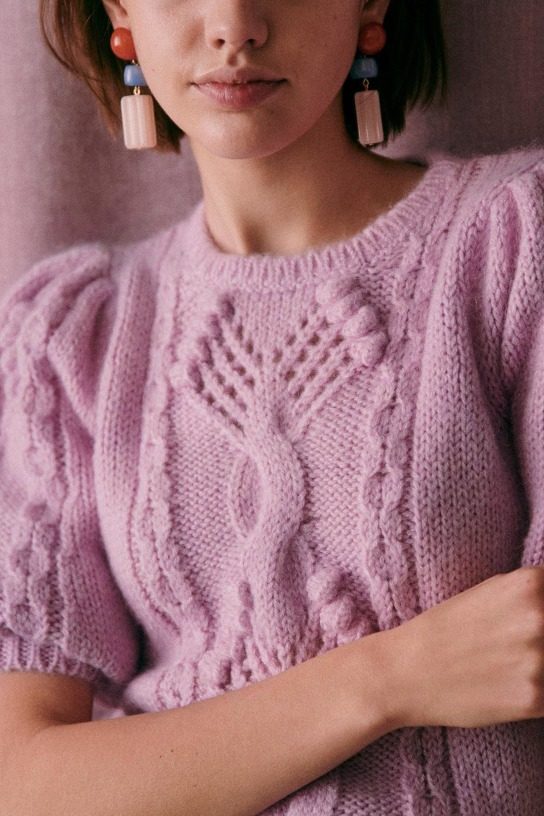

Knitwear appears to be a very important category, as it continuously gains momentum from FW19 (+42%), and is adapting to new product, such as trousers, shorts and one piece, latter for the more edgy brands. Meanwhile knitwear dresses, jumpers and cardigans remain a safe bet. Openworks and mohair are the knit novelty of this early spring season and ribs continue to be a stable trend.

Early Spring 21 Drop Analysis

Global Assortment

Let's analyze early Spring Summer 21 collection drops of the ten most successful premium brands in France. These brands have delivered 135 skus on average of which 17% is represented by accessories.

RTW Segmentation

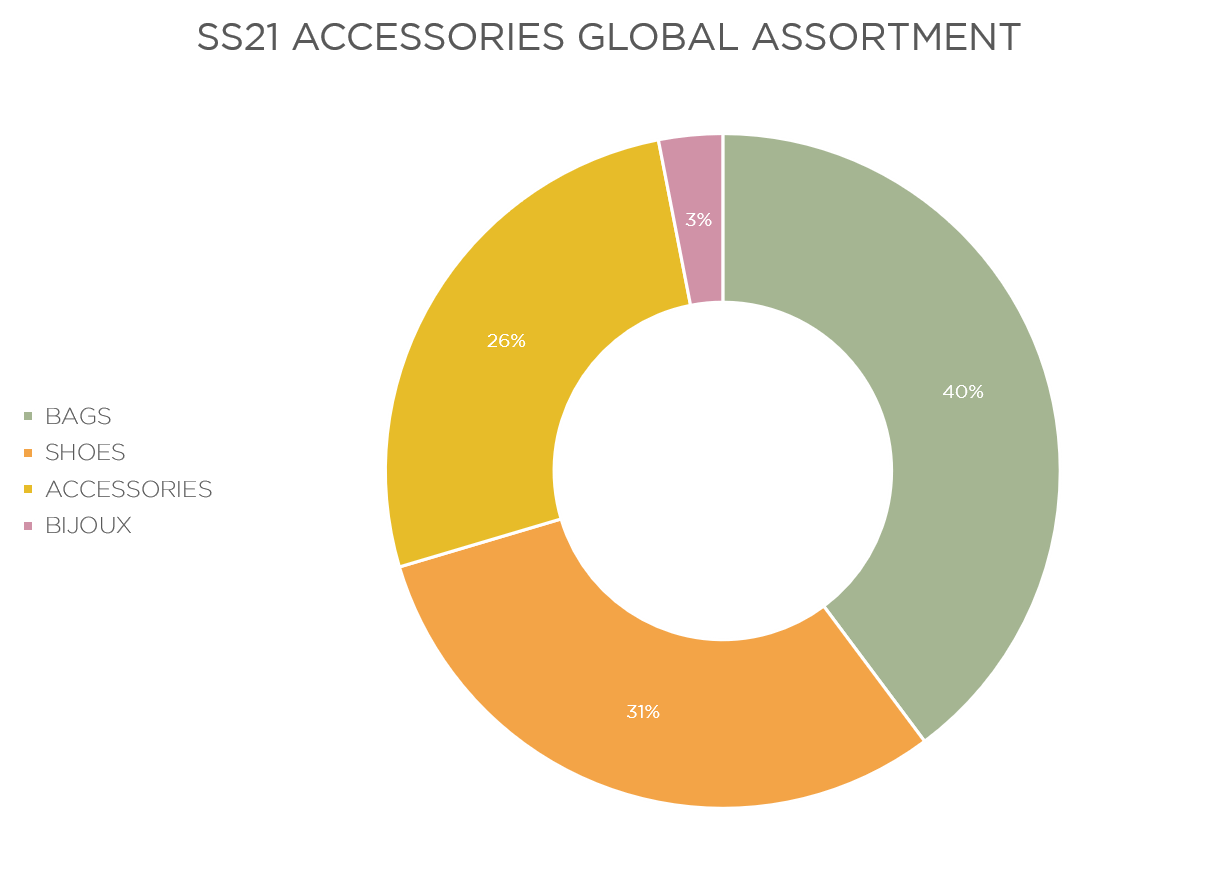

Accessories Segmentation

The French Premium Brands have delivered a small number of accessories this February compared to the last year. Bags are composing 40% of the offer, followed by footwear taking up 31% and SLG with 26%.

It is important to note, that ankle boots, combat boots or rain boots are still a hot trend for this beginning of the season. They have gained 27% year on year in retail and safeguarded high visibility on Instagram, thanks to the successes of the Bottega Veneta chunky boots and the Chloé Betty rain boots.

Tracksuit Style

Pijama Like

Cropped Jacket

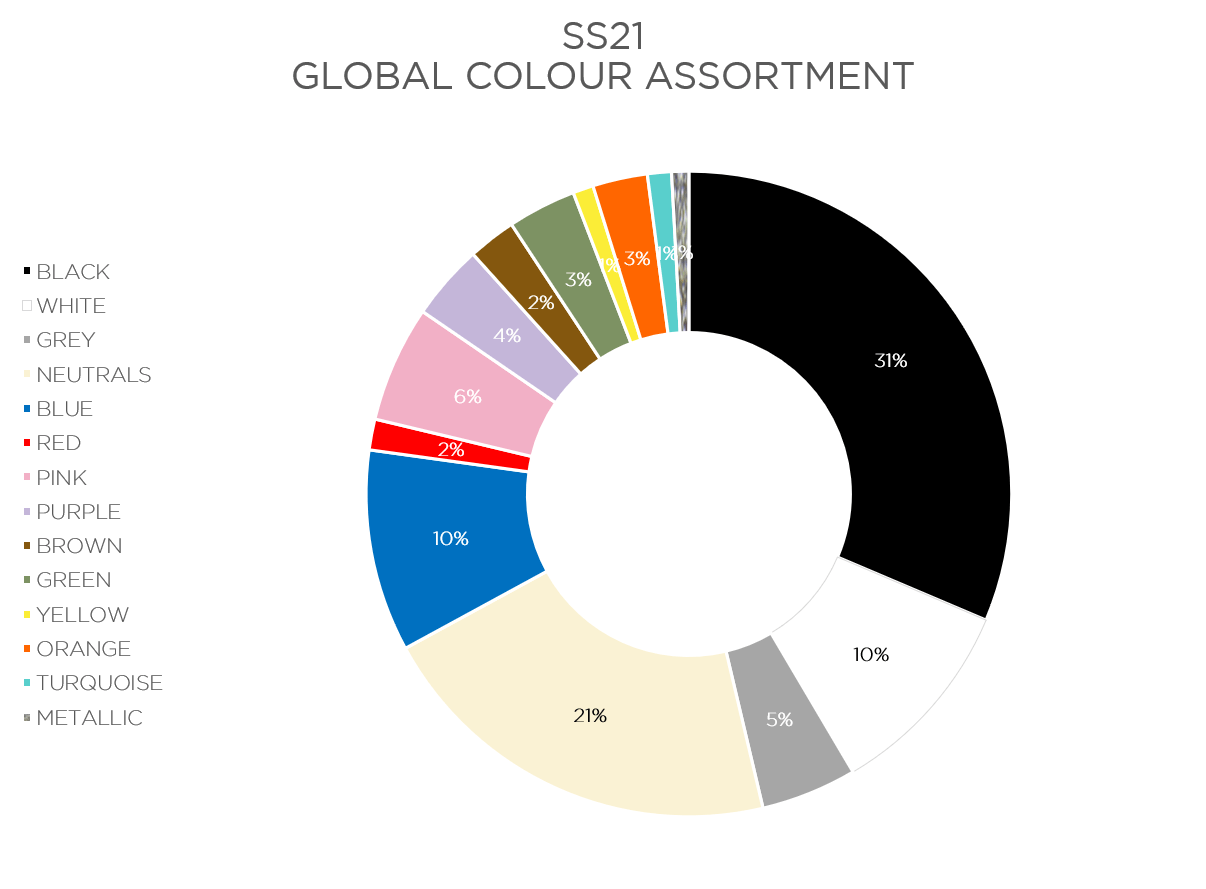

Global Colour Palette

At the start of the season, blacks and neutrals are dominating the range of the collections, together accounting for 52% of the assortment. Black is gaining 6% year to date.

Looking at the more fashion colours, pastels are maintaining their importance of introducing freshness, as they are representing 15% of the global colour range. Lilas and pink shades both share the title of the season color highlight, while khakis and oranges are emerging to be part of the palette. Red remains on the sidelines for this early season, losing 2%, while earthy tones gain 1% compared to the last year,.

Khaki

Prints & Patterns

Preppy Checks

Tweed

Indian Garden

Florals

Blurred Prints

Wavy Animaliers

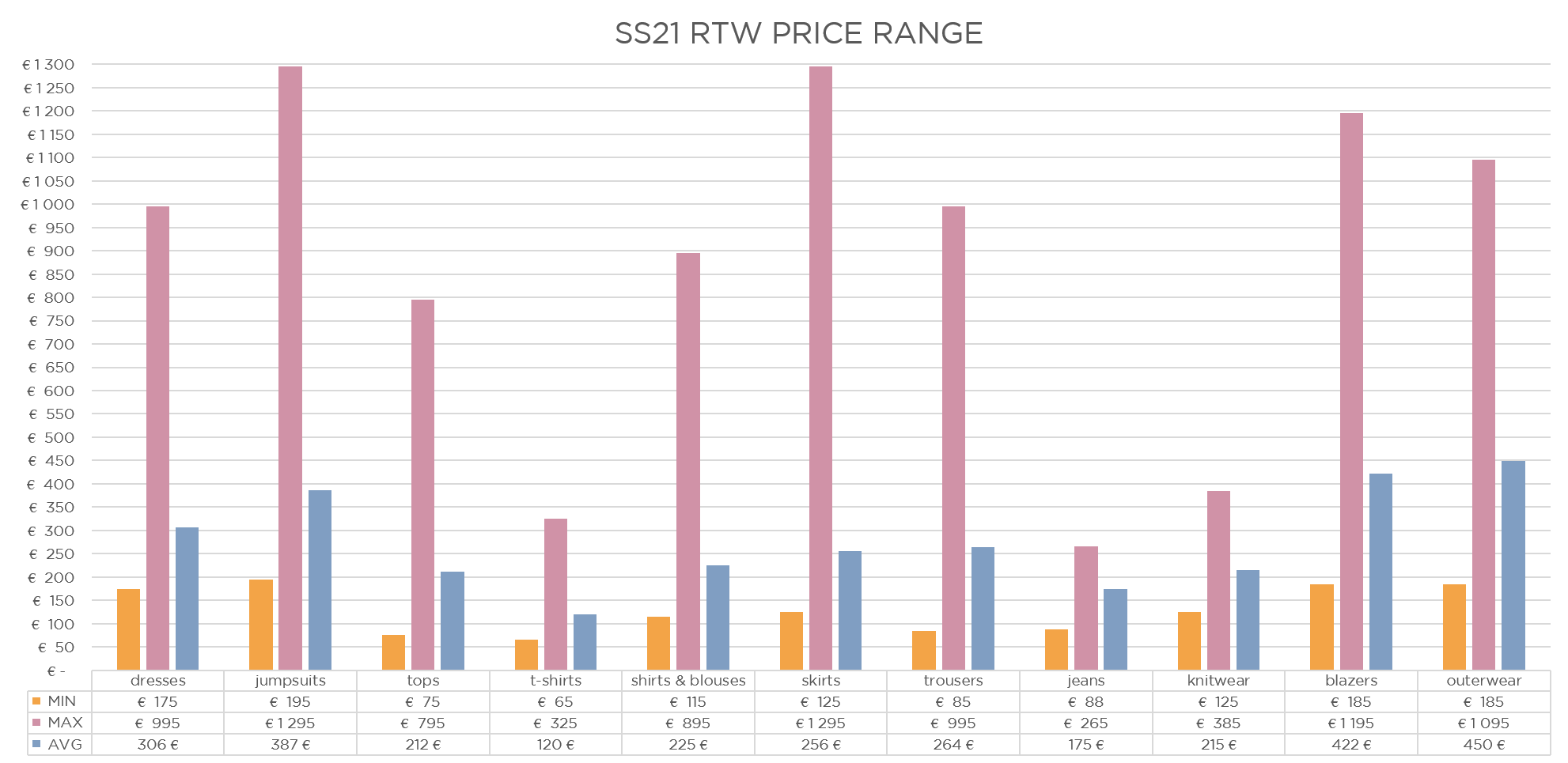

R-T-W Price Architecture

Early Spring 21 starts with a price range between 65€ and 1295€ for premium brands. Where the higher average prices are represented by outerwear, followed by blazers and jackets, jumpsuits and lastly dresses. The clear representation of high-priced fashion products in the collections translates into brands still betting on stronger statement pieces, despite the pandemic’s conditions. This early spring season doesn’t underline a change in pricing strategy for the moment, which could have been expected due to the economic crisis and the recessionary intention to focus on more long-lasting products. Pieces will less likely becoming subject to strong discounts, but follow a strategy based on more calibrated purchases in order to reduce stocks to a minimum. Wherever possible, production has been moved near-shore in order to be more reactive for re-stocking.

Knitwear focus

New Pieces

Openwork

Bare Back

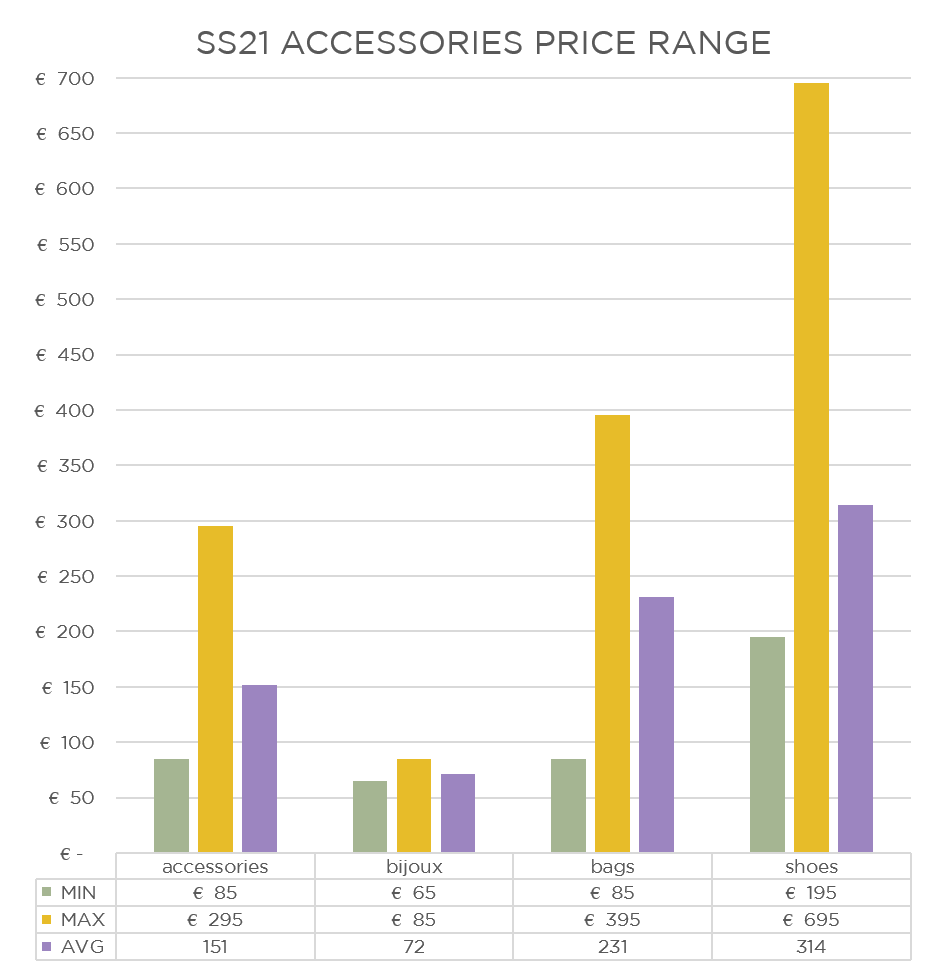

Accessories Price Structure

Concerning the accessories, shoes have lost some ground, especially pumps. Premium brands prefer to present boots and sneakers and trend is definitely towards flat shoes. On the other hand, bags gain 1% and prices remain under 400€ for an iconic bag from one of those affordable luxury brands.

Chunky Boots

Loafers

Ask for a Custom Report

This analysis is done by collecting data on the e-commerce websites of the most successful affordable luxury brands in France on 15/02/2021. The brands include: Ba&sh, Claudie Pierlot, Iro, Maje, Sandro, The Kooples and Zadig&Voltaire. Prices are collected on French market for this report.

Ask for tailored analysis of your direct competitors or compared analysis with your brand collection at contact@livetrend.co